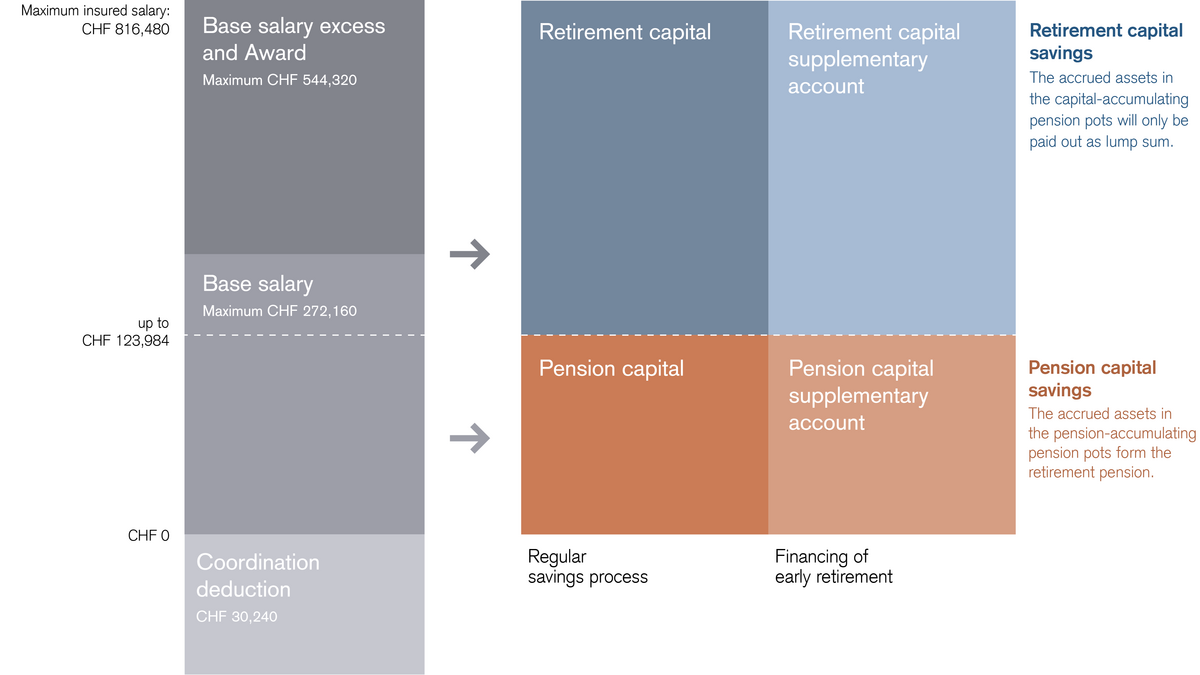

If your pensionable salary together with any award amounts to CHF 123,984 or less, your savings contributions and those of your employer will be allocated in full to the pension capital pension pot. The accrued assets on retirement form the basis of your retirement pension.

Contributions for salary components exceeding CHF 123,984 will be allocated to the retirement capital pension pot. On retirement, the accrued assets will be paid out in the form of a lump sum.

No savings contributions accrue to the pension capital supplementary account or the retirement capital supplementary account. The accrued assets in these two pension pots are accumulated solely from payments made by you.

Maximum insured contributions

The salary components insured in the Pension Fund amount to a maximum of CHF 816,480. These are made up of:

Savings and risk contributions

You and the employer pay monthly savings contributions defined as a percentage of your pensionable salary. These contributions are credited to you individually and, together with interest, the vested benefits brought into the fund and any additional deposits, form your retirement savings capital.

You have the option to specify the amount of the savings contributions yourself. The Basic, Standard and Top contribution options include both the savings contributions for your pensionable base salary as well as those for any pensionable awards and base salary excess. You can adjust your contribution options on a monthly basis at:

The contribution option you choose will not affect the amount contributed by the employer. Depending on your age and the contribution option chosen, the following savings contributions apply:

Other topics